Introduction

Stock trading has become more accessible than ever, thanks to the rise of stock trading apps that offer real-time market data. Whether you’re an experienced investor or just getting started with your investment portfolio, choosing the best stock apps can make a significant difference in managing your investments.

Table of Contents

Key Takeaways

- Real-time market data is crucial for active traders, retail investors, and those managing an investment portfolio.

- Stock apps provide essential tools like real-time account tracking and commission-free trading.

- These tools are indispensable for both beginners and experienced investors.

- The best stock trading apps offer a range of features from commission-free trades to advanced trading tools.

- Investment apps vary in their offerings, so it’s important to choose one that matches your investment goals, including mutual funds and exchange-traded funds (ETFs).

Best Stock Trading Apps

1. E*TRADE: The Best for Active Traders

ETRADE offers a powerful platform that caters to those who are active in stock and ETF trades. It provides access to real-time market data, allowing users to make informed decisions quickly. With commission-free trades on stocks and ETFs, ETRADE is designed for traders who seek both value and advanced functionality. The platform’s educational resources and intuitive interface make it suitable for both beginners and more experienced investors.

Key Features:

- Real-time market data and market news

- Commission-free trades on stocks and ETFs

- Advanced trading tools and mobile trading apps

Pros:

- User-friendly interface

- Access to educational resources for understanding stock trading and investment options

- Extensive investment options including mutual funds and ETFs

Cons:

- Advanced trading platforms may be overwhelming for new users

Did you know?

E*TRADE offers a desktop platform that provides comprehensive tools for stock trading, making it a favorite among active traders.

2. Fidelity Investments: Best for Long-Term Investors

Fidelity Investments is well-suited for long-term investors who prioritize thorough research and comprehensive investment tools. It offers commission-free stock trading, real-time market data, and access to a wide range of investment options, including mutual funds, ETFs, and various types of brokerage accounts. Fidelity’s strong customer support and robust platform make it a reliable choice for those looking to build and manage a diversified investment portfolio over the long haul.

Key Features:

- Commission-free stock trading

- Access to fractional shares, mutual funds, and ETFs

- Investment portfolio management tools

Pros:

- Excellent customer service

- Wide range of investment choices, including mutual funds and ETFs

- No trading fees on commission-free trades

Cons:

- Some fees may apply for non-commission-free investment options

Fact:

Fidelity’s stock trading app allows retail investors to trade fractional shares, making it easier to diversify their investment portfolio.

3. Robinhood: Best for Retail Investors

Robinhood is an accessible platform known for its commission-free trading on stocks, ETFs, and options. It’s particularly favored by retail investors who are just beginning their trading journey. The app’s user-friendly design, combined with real-time market data, makes it easy for users to start trading without getting overwhelmed by fees or complicated tools. Robinhood is ideal for those who want a straightforward way to enter the stock market.

Key Features:

- Real-time market data

- Commission-free trades on stocks, ETFs, and options

- Access to cryptocurrency trading

Pros:

- No account fees or minimums

- Simple, intuitive design suitable for beginner investors

Cons:

- Limited research and educational resources compared to other stock trading apps

4. Webull: Best for Active and Experienced Investors

Webull offers a sophisticated trading environment tailored to the needs of active and experienced investors. The app includes advanced charting tools, technical indicators, and commission-free trades on stocks and ETFs. Webull also provides real-time market data and supports extended hours trading, making it a versatile choice for those who require more control and insight into their trades.

Key Features:

- Advanced charting tools and technical indicators

- Free stock trading with no commissions

- Access to ETFs, options, and more

Pros:

- Comprehensive mobile apps for trading on the go

- Extended hours trading, including pre-market and after-hours

Cons:

- Limited investment options compared to larger brokers

Did you know? Webull’s stock trading app offers free trades on stocks and ETFs, making it an excellent choice for active traders seeking real-time market insights.

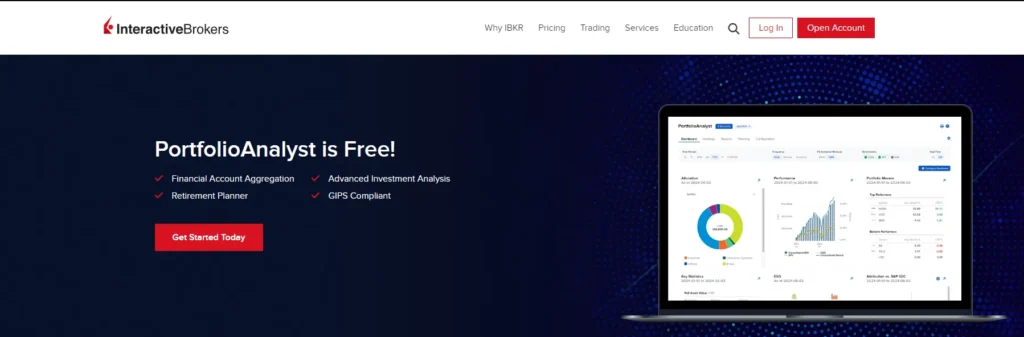

5. Interactive Brokers: Best for Global Market Access

Interactive Brokers provides a gateway to global markets, making it a top choice for investors who want to trade internationally. The platform offers competitive trading fees, real-time market data, and a vast array of investment options, including stocks, ETFs, and options. Interactive Brokers is known for its advanced trading tools and detailed research resources, which cater to experienced traders who require comprehensive market access.

Key Features:

- Real-time market data and news

- Access to global markets with low trading fees

- Extensive investment research and analysis tools

Pros:

- Access to a broad range of investment platforms, including stocks, ETFs, and options

- Advanced trading tools and investment options for experienced investors

Cons:

- Platform may be complex for beginners

6. TD Ameritrade: Best for Comprehensive Investment Options

TD Ameritrade is a versatile platform that appeals to both active traders and those focused on long-term investments. With commission-free trades on stocks, ETFs, and options, as well as access to real-time market data, it supports a wide range of investment strategies. The platform’s educational tools and the thinkorswim trading platform provide in-depth market analysis, making it a strong option for investors at any level.

Key Features:

- Commission-free trades on stocks, ETFs, and options

- Advanced trading tools like thinkorswim

- Educational resources for all levels of investors

Pros:

- Extensive range of investment options, including mutual funds and ETFs

- User-friendly platform that caters to both beginner and experienced investors

Cons:

- Some fees for certain mutual funds and managed portfolios

Did you know?

TD Ameritrade’s mobile trading apps allow you to manage your entire investment portfolio on the go, providing real-time market data wherever you are.

7. Charles Schwab: Best for Long-Term Wealth Building

Charles Schwab is a well-established platform known for supporting long-term wealth-building strategies. The app offers commission-free trading on stocks and ETFs, along with the option to trade fractional shares. Investors benefit from real-time market data and extensive research tools that help in making informed decisions. Charles Schwab’s reliability and comprehensive investment options make it a preferred choice for those focusing on sustained portfolio growth.

Key Features:

- Fractional shares trading

- Extensive research and market news

- No commissions on stocks, ETFs, and options

Pros:

- Reliable customer service and support

- Access to a broad range of investment platforms, including advanced trading platforms for active traders

Cons:

- Limited features on mobile apps compared to desktop platforms

8. SoFi Invest: Best for Beginners

SoFi Invest is designed to make investing accessible to beginners. The platform offers a simple, intuitive interface with commission-free trading on stocks, ETFs, and cryptocurrencies. Real-time market data and no account fees make it easy for new investors to get started without significant barriers. SoFi’s additional financial planning resources provide valuable guidance, helping users make informed investment decisions.

For those who are exploring various financial tools, looking into applications for quick loans can be a smart choice if you need immediate funds to support your stock trading activities or other financial ventures.

Key Features:

- Real-time market data

- No account fees or commissions on trades

- Access to ETFs, stocks, and cryptocurrency

Pros:

- Simple, user-friendly interface for beginner investors

- Free financial planning resources

Cons:

- Limited investment choices compared to more established brokers

9. Ally Invest: Best for Low-Cost Trading

Ally Invest is an excellent option for those looking to minimize trading costs while accessing a broad range of investment opportunities. The app offers low-cost trading on stocks and ETFs, supported by real-time market data and research tools. Ally Invest’s seamless integration with its banking services allows for easy management of both savings and investment accounts, making it a convenient choice for cost-conscious investors.

Key Features:

- Real-time market data and research

- Low-cost trading fees on stocks and ETFs

- Wide range of investment options, including mutual funds and bonds

Pros:

- Integration with Ally’s banking services

- No account minimums, making it accessible to all investors

Cons:

- Less comprehensive educational resources compared to other apps

10. M1 Finance: Best for Automated Investing

M1 Finance combines automated investing with self-directed portfolio management, offering a unique approach to building wealth. The platform provides real-time market data and commission-free trading, allowing users to create and manage customized portfolios. M1 Finance’s automated features handle the day-to-day management, making it ideal for those who prefer a hands-off investment approach while still retaining control over their investment strategy.

Key Features:

- Real-time market data and alerts

- Commission-free trading with fractional share options

- Automated portfolio management with personalized investment strategies

Pros:

- Customizable investment portfolios

- No trading fees or commissions

Cons:

- Limited research tools compared to other stock trading apps

11. TradeStation: Best for Advanced Traders

TradeStation is built for advanced traders who need powerful tools and detailed market data. The platform supports trading in stocks, options, ETFs, and even futures and forex. It provides real-time market data and advanced trading platforms that cater to sophisticated investment strategies. TradeStation’s extensive research tools and high-level trading capabilities make it a top choice for those serious about their trading activities.

Key Features:

- Comprehensive trading tools for stocks, options, and ETFs

- Access to futures and forex trading

- Real-time market data and alerts

Pros:

- Robust trading platforms for advanced traders

- Extensive investment research and analysis tools

Cons:

- Higher fees for some services and advanced trading tools

Stock Trading App Safety and Security

Safety and security are paramount when choosing a stock trading app. Trading apps from established U.S.-based brokerage firms are generally safe against theft and broker insolvency. These brokers are among the most highly regulated financial service providers in the world, going to great lengths to protect your privacy and assets.

In the United States, your investments are protected against the loss of cash and securities by the Securities Investor Protection Corporation (SIPC). However, it’s important to note that SIPC insurance does not cover losses due to market fluctuations. Your investment decisions will play a far more significant role in determining the safety of your portfolio than the risk of fraud or theft.

To enhance the cybersecurity of your trading app, consider enabling two-factor authentication, keeping your mobile phone software up to date, enabling biometric access, and using a strong password. These measures can help protect your account from unauthorized access and ensure that your trading experience remains secure.

By choosing a reputable trading app and taking proactive steps to secure your account, you can trade with confidence, knowing that your investments are well-protected.

Conclusion

Choosing the best stock trading app depends on your individual needs, investment goals, and experience level. Whether you’re looking for commission-free trades, advanced trading tools, or access to real-time market data, the apps listed above offer a range of features to help you succeed in the stock market. Remember to consider your own financial situation and investment goals when selecting the right app for you.

FAQs

1. What is the best stock trading app for beginners?

Robinhood is popular among beginners due to its simple interface and commission-free trades.

2. Do all trading apps offer real-time market data?

Most top-tier trading apps provide real-time market data, but the level of detail and access may vary.

3. Are there any hidden fees in commission-free trading apps?

While many apps offer commission-free trades, it’s essential to check for other fees, such as account maintenance or withdrawal fees.

4. Can I trade fractional shares on these apps?

Yes, many of the apps listed, such as Fidelity Investments and Charles Schwab, offer fractional share trading.

5. What are the benefits of using a mobile trading app?

Mobile trading apps offer the convenience of managing your investment portfolio on the go, providing real-time market data and the ability to trade stocks, ETFs, and more anytime, anywhere.