Managing an investment portfolio can be challenging, especially when juggling multiple investment accounts and brokerage accounts.

Fortunately, selecting the right investment tracker apps can simplify this task, providing a comprehensive view of your financial accounts, including retirement accounts and bank accounts.

Below are the 12 best portfolio management apps/ Investment Tracker Apps that will help you stay on top of your investments in 2024.

Table of Contents

What is a Investment Tracker Apps?

A Investment tracker apps is a software application that allows you to manage and monitor your investment portfolio in real-time.

These apps connect to your investment accounts, track your asset allocation, and provide insights into your investment performance.

With a Investment tracker apps, you can easily view your entire investment portfolio, including stocks, bonds, mutual funds, ETFs, and other assets, in one place.

This centralized approach simplifies the process of tracking your investments and helps you maintain a clear understanding of your financial health.

Key Takeaways

- Monitor all your investments: Track everything from stocks to mutual funds in one place.

- Optimize your asset allocation: Ensure your portfolio is well-diversified across different asset classes.

- Enhance investment tracking: Use these apps to maintain a detailed view of your portfolio’s performance.

Best Investment Tracker Apps

| App Name | Best For | Key Features | Pros | Cons |

|---|---|---|---|---|

| Empower (Personal Capital) | Comprehensive Wealth Tracking | Tracks investments, retirement, and net worth; offers retirement planner | Holistic view of finances, great visual tools, free financial tools | Advanced tools behind paid advisory service |

| Morningstar | Research & Detailed Analytics | In-depth stock/fund analysis, X-Ray tool, performance benchmarking | Professional-level insights, great for DIY investors | Can be overwhelming for beginners, some tools require premium access |

| SigFig | Automated Portfolio & Tracking | Portfolio management, real-time tracking, investment advisory | Simple interface, syncs with most brokerages, low-cost robo-advisor | Fewer customization options |

| Yahoo Finance | Casual Investors & Watchlists | Custom watchlists, real-time market news and portfolio tracking | Easy to use, integrates news & financials | Ads can be intrusive, less detailed analytics |

| Kubera | Net Worth Tracking Across Accounts | Tracks global assets, crypto, stocks, real estate, even collectibles | Clean dashboard, great for high-net-worth users | Subscription-based ($150/year) |

| Zerion | Crypto Portfolio Tracking | Connects DeFi wallets, NFT tracking, real-time asset tracking | Great UI, DeFi focused, portfolio analysis | Focuses only on crypto |

| Delta | Crypto + Stock Hybrid Tracking | Syncs with wallets & brokerages, price alerts, portfolio analytics | Multi-asset tracker, sleek mobile app | Premium version required for advanced insights |

| CoinStats | Crypto Investors | All-in-one crypto tracking, exchange syncing, DeFi support | Real-time syncing, portfolio performance visualization | Limited traditional investment features |

| Sharesight | Tax Reporting & Dividend Tracking | Tracks global stocks, generates capital gains/dividend tax reports | Perfect for active traders/investors, strong reporting tools | More complex UI, better for experienced users |

| Tiller Money | Spreadsheet-Based Customization | Links to Google Sheets/Excel, auto-imports transactions & investments | Fully customizable, for spreadsheet lovers | Requires manual setup and spreadsheet comfort |

| Quicken Simplifi | Full Personal Finance & Investment View | Budgeting + investment tracking in one, mobile-friendly UI | All-in-one dashboard, budgeting included | Monthly subscription, limited investing tools vs. others |

| TrackMySubs | Subscription Expense & Investing Combo | Tracks recurring expenses with optional investment notes | Unique angle, great for side-by-side view of spending & investing | Not a full-featured investment tracker |

1. Personal Capital

Personal Capital, now rebranded as Empower, remains one of the top choices for portfolio tracking. This app allows you to monitor your total investment portfolio, including multiple investment accounts and financial assets. With its comprehensive portfolio tracker, you can analyze your asset allocation, track your net worth, and plan for retirement.

Key Features

- Comprehensive portfolio management: Integrates all your financial accounts for easy monitoring.

- Retirement planning tools: Includes a retirement planner that assesses your readiness for retirement.

- Financial advisors: Access to personal capital advisors for tailored advice.

Did you know?

Personal Capital Advisors Corporation offers advisory services that can help you navigate complex investment decisions.

2. Yahoo Finance

For those who need a reliable stock portfolio tracker app, Yahoo Finance is an excellent choice. It not only tracks your stock portfolio but also provides tools for investment research. With Yahoo Finance, you can monitor financial data in real time, helping you make informed investment decisions.

Key Features:

- Stock portfolio tracking: Keep track of your stock portfolio and receive custom alerts.

- Investment research platform: Access detailed investment research to improve your strategy.

- Financial data integration: Easily sync and track your brokerage accounts and other financial assets.

3. Morningstar Investor

Morningstar Investor is known for its in-depth investment research and robust portfolio monitoring tools. It’s ideal for those who want to keep an eye on their portfolio’s performance and ensure their portfolio quality is up to standard.

Key Features:

- Detailed portfolio analysis: Monitor and analyze your portfolio holdings.

- Model portfolios: Gain insights from professionally managed model portfolios.

- Investment strategy insights: Leverage Morningstar’s data to refine your investment strategy.

Fact:

Morningstar Investor is a trusted investment research platform widely used by both individual and institutional investors.

4. Wealthfront

Wealthfront is a leading robo-advisor that also offers solid portfolio management features. Its automated system helps you maintain optimal asset allocation and manage your retirement accounts.

Key Features:

- Robo-advisor management: Automated investment management across multiple investment accounts.

- Tax reporting: Optimize your returns with tax-loss harvesting and other strategies.

- Retirement planning tools: Detailed tools for retirement planning and tracking.

Did you know?

Wealthfront’s robo-advisor adjusts your portfolio holdings automatically to align with your risk tolerance.

5. Empower (Formerly Personal Capital)

As one of the best portfolio tracking apps, Empower, previously known as Personal Capital, provides an all-encompassing view of your finances, from investment accounts to retirement planning tools. It allows you to track your net worth and analyze your investment performance effectively.

Key Features:

- Net worth tracking: Comprehensive tools to monitor your overall personal wealth.

- Portfolio quality analysis: Helps you evaluate and enhance your portfolio’s performance.

- Advisory services: Access to the Empower Advisory Group for professional investment guidance.

6. SigFig

SigFig offers a streamlined experience for tracking your investments. It connects to all your financial accounts and offers insights into your portfolio’s performance, helping you make better investment decisions.

Key Features:

- Sync multiple portfolios: Manage and track multiple investment accounts in one place.

- Risk tolerance: Provides tools to assess and manage your risk.

- Free portfolio tracker: Access basic tracking tools without any cost.

7. Mint

Mint is more than just a budgeting app; it also offers investment tracking capabilities. You can monitor your investment portfolio, bank accounts, and other financial assets all in one place.

Key Features:

- All-in-one financial management: Consolidates all your financial data, including investment tracking.

- Investment performance tracking: Easily keep an eye on how your investments are performing.

- Free tools: Access a wide range of financial tools at no cost.

8. Quicken

Quicken is a comprehensive tool that offers both budgeting and portfolio management features. It’s ideal for those looking to manage their portfolio’s performance alongside other aspects of their financial life.

Key Features:

- Advanced portfolio tracking: Detailed analysis of your portfolio holdings and performance.

- Tax reporting: Simplifies tax preparation with detailed investment reports.

- Retirement planning tool: Includes tools to help you prepare for retirement.

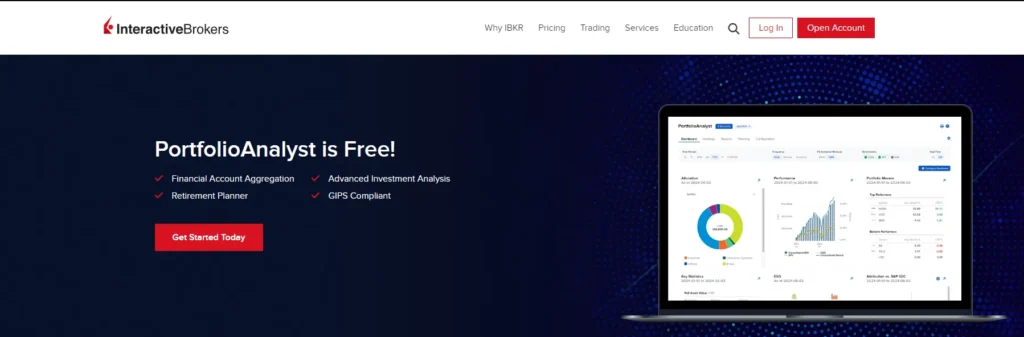

9. Interactive Brokers

Interactive Brokers is a top choice for active investors who need advanced investment research and portfolio tracking capabilities. The app provides in-depth analysis and customizable tools to manage your investment portfolio effectively.

Key Features:

- Comprehensive investment research platform: Access to detailed financial data and reports.

- Advanced portfolio management: Customizable tracking and analysis tools for your investment portfolio.

- Multiple portfolios: Manage several portfolios simultaneously with ease.

10. E*TRADE

E*TRADE offers a robust portfolio tracker integrated with its brokerage accounts. It’s particularly strong in managing retirement accounts and provides a range of tools for retirement planning.

Key Features:

- Retirement planning tools: Detailed features for managing and planning your retirement.

- Portfolio quality analysis: Helps improve the quality and performance of your investments.

- Tax reporting: Easy tax preparation with detailed reports on your investment accounts.

11. Fidelity Investments

Fidelity Investments offers a range of portfolio management apps that cater to both novice and experienced investors. With tools for tracking your investment portfolio and managing your financial assets, Fidelity ensures you have everything you need to succeed.

Key Features:

- Portfolio management: Monitor and manage all your investments, including mutual funds and exchange traded funds.

- Risk tolerance assessment: Tools to help you manage and understand your risk.

- Retirement planning tools: Features to help you plan and track your retirement goals.

12. Vanguard

Vanguard is a top pick for those who prefer a hands-on approach to managing their investment portfolio. With its focus on low-cost investing, Vanguard helps you maintain control while keeping fees low.

Key Features:

- Low-cost portfolio management: Keep your expenses low while managing a diversified investment portfolio.

- Portfolio simulator: Simulate potential investment outcomes based on various strategies.

- Multiple portfolios: Manage and track various portfolios, including retirement accounts and brokerage accounts.

Key Features of a Portfolio Tracker

A good portfolio tracker app should have the following key features:

- Real-time data and monitoring: The app should sync with your investment accounts and provide real-time updates on your portfolio’s performance, ensuring you always have the latest information at your fingertips.

- Asset allocation analysis: The app should analyze your asset allocation and provide recommendations for optimization, helping you maintain a well-diversified portfolio.

- Investment tracking: The app should track your investments, including stocks, bonds, mutual funds, ETFs, and other assets, giving you a comprehensive view of your holdings.

- Financial planning tools: The app should offer financial planning tools, such as retirement planning and investment goal setting, to help you achieve your long-term financial objectives.

- Security: The app should have robust security measures in place to protect your financial data, ensuring your information remains safe and secure.

Best Portfolio Tracker Apps for Specific Needs

Here are some of the best portfolio tracker apps for specific needs:

- Best for beginners: Empower (formerly Personal Capital) – A user-friendly app that offers investment tracking, asset allocation analysis, and financial planning tools. Empower’s intuitive interface makes it easy for beginners to get started with investment tracking.

- Best for advanced investors: Morningstar – A comprehensive investment research platform that offers portfolio tracking, asset allocation analysis, and financial planning tools. Morningstar’s detailed insights and analysis cater to the needs of advanced investors.

- Best for international investments: Sharesight – A portfolio tracker that offers investment tracking, asset allocation analysis, and financial planning tools, with a focus on international investments. Sharesight’s global perspective makes it ideal for investors with international holdings.

- Best for cryptocurrency investments: Delta – A cryptocurrency-focused portfolio tracker that offers investment tracking, asset allocation analysis, and financial planning tools. Delta’s specialized features make it a top choice for cryptocurrency investors.

By using a portfolio tracker app, you can take control of your investments and make informed decisions about your financial future. Whether you’re a beginner or an advanced investor, there’s a portfolio tracker app out there that can help you achieve your financial goals.Check out our guide on the best stock trading apps for more options.

Conclusion

Choosing the right portfolio tracking apps is crucial for effectively managing your investments.

These apps provide a wide array of tools, from investment tracking to portfolio management, helping you keep a close eye on your portfolio’s performance.

By utilizing these apps, you can make informed investment decisions and ensure that your financial future is on the right track. For broader financial management, consider integrating some of the best expense tracker apps.

FAQs

What are the best apps for tracking multiple investment accounts?

Personal Capital and Morningstar Investor excel in managing multiple investment accounts and providing detailed analysis of your investment portfolio.

Can these apps assist with retirement planning?

Yes, many of these apps, such as Personal Capital, Wealthfront, and Fidelity Investments, offer robust retirement planning tools to help you prepare for the future.

Are these portfolio trackers suitable for all types of investors?

Absolutely! Whether you’re an active investor, a beginner, or somewhere in between, apps like Mint, SigFig, and Fidelity Investments cater to various investment styles.

Do these apps support tax reporting?

Yes, several of these apps, including Quicken and E*TRADE, provide detailed tax reporting features to simplify your tax preparation.